Buying A Watch Is Mostly Vibes—Here’s the Actual Data | Auction Report

A data-driven look at auctions: Which brands beat expectations, which didn’t, and where collectors can find value.

It started with a simple question: Is the demand for Lange as soft as some people say? A few hours later, I had a spreadsheet of all 360+ lots from the New York auctions.

Auctions are full of data, but analysis often feels hand-wavy. Here are a few big Journe results, FP is still red hot. A Cartier Bamboo sold for $177k, isn’t that crazy?

Instead, I wanted to look at aggregate results. Which brands performed well, and which didn’t? Even if you’re not a player at auctions, they can provide great market signals.1

Auction houses will often compare final hammer prices (i.e., the total before the all-in price, which includes those hefty buyer’s premiums) as a percentage of the low and high estimates, since estimates are made on a pre-premium basis. It’s not perfect, but it works. Anywhere from 80-100% of the high estimate can be considered expected to strong performance.

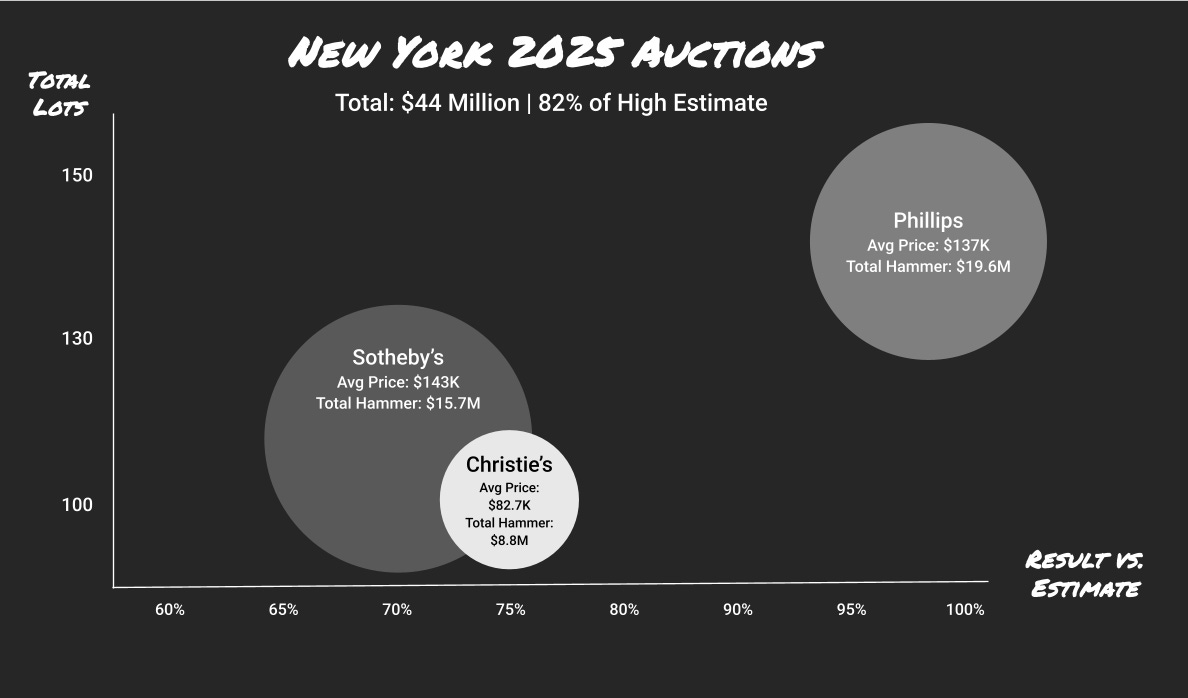

Across New York, the three large auctions sold $44 million of watches ($55 million all-in), 82% of the high estimate across sales:

It gives a picture of a market that’s stable, if not strong, especially because a few big-time watches underperformed.2 Interestingly, misses by some of the biggest lots in Geneva last month also weighed down performance. I don’t hang out on yachts enough to know what to make of that, and so few collectors are buying multi-million-dollar watches that it doesn’t take much for a thin market to disappear. Most of these top lots were also known to the market, a recipe for mediocre results nowadays.

I was on the Hairspring podcast with Erik & Max, where we talk pet peeves, build our $20k & $200k collections, and I force Max to consider a Grand Seiko:

The Scoreboard: Who’s Winning at Auction

Despite all the noise, I believe that, over the long term, market value follows from historical importance. Right now is such an interesting time because an up-and-coming generation of collectors (Millennials) is deciding which watches, often from a new generation of “collectible” watches (roughly, 1980s-2000s), carry the most historical importance for them. This is also happening at the same time as the “Great Wealth Transfer” from Baby Boomers to Millennials.

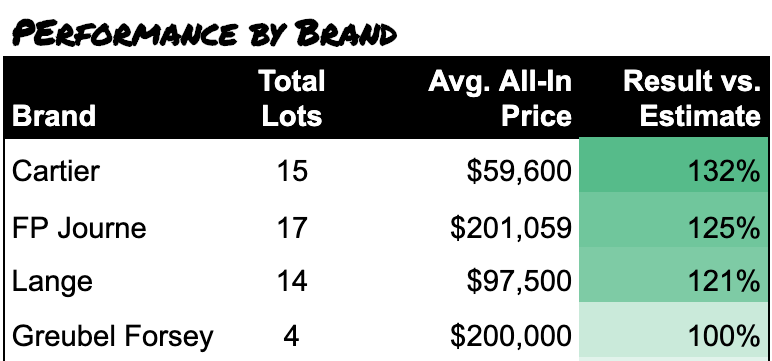

For collectors, this makes it useful to track brand performance, so I summarized results of 15 of the largest brands. The key figure is the last column, the brand’s total hammer price against its high estimate. Cartier performed best compared to expectations—the hammer total for its 15 lots was 132% of the high estimate: