Good morning. Unpolished exists because of subscribers like you. I’m heading to Geneva for 8 days and excited about what’s in store for the rest of 2025. Now’s a good time to upgrade:

All paid subscribers get 10% off in the Unpolished Store, and all annual subscribers get a $50 discount on a service from Watchcheck.

Thanks for the thoughtful feedback on this week’s essay about developing your own taste. I also published the audio version this morning if you’d rather listen. Subscribe to the podcast feed while you’re there: Spotify / Apple / RSS.

Today’s main event: A London dealer that went into administration, and what collectors can learn from it. But first—

The Roundup

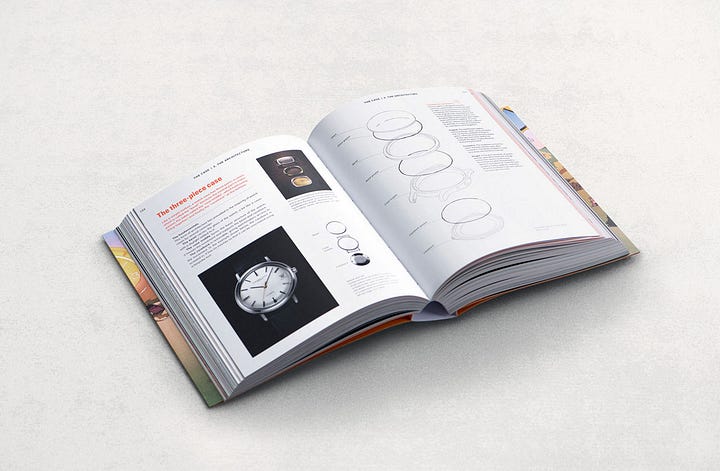

Audemars Piguet released a good book. To mark its 250th anniversary, AP has published The Watch. I asked for a preview and was sent a PDF of all 700 pages, but enjoy it enough that I’ll order a physical copy. It takes you through every part of the watch in some detail: Dial, case, bracelet, movement, and complications. It’s AP-focused, but the info about techniques and components is broadly applicable. For example, some of the content in the “Dial” section is similar to Dr. Helmut Crott’s book of the same name. Tons of images, and the price feels reasonable: On Amazon, I’ve seen from $78 (as I write this) to $95. (Amazon)

The Cartier Santos wears like a piece of jewelry. Cartier recently introduced a pair of new Santos models, one with a grey dial, the other in bead-blasted titanium. The modern, large Santos is just too big for me, but I thought I’d offer thoughts about having once owned a Santos.

I used to have the Cartier Santos Galbée “SIHH,” a limited edition of 2000 from 2002. It’s the best Santos (obviously!), with a grey dial, luminous numerals, and no date.1 I had it for ~2 years before deciding it wasn’t for me. Those bolts on the bracelet are unmistakably Cartier—like a Love Bracelet, even if you know nothing about watches. It felt more like a piece of jewelry than a watch. Once I got that in my head, I couldn’t shake it. Now, you might say, the Rolex President/Jubilee/Oyster bracelet is just as recognizable. And you might be right, but something about the Cartier Look is just different.

I imagine what I didn’t like about the Santos is part of what makes it massively popular. Here’s SJX on the titanium Santos de Cartier.

Gene Hackman had some cool Seikos. A pair of Seiko divers is being sold in Bonham’s auction of Gene Hackman’s estate in December. The estimate is $500–700, but I have to imagine they’ll sell for more. So many great Hackman roles, but growing up in Indiana, Hoosiers is less a movie than a religious experience. (Bonham’s)

You can buy Rolex cufflinks for $5,800. An Oyster Perpetual 36 is $6,350.

Like some collectors I know, Wall Street is placing bets on tariff refunds. (Bloomberg)

🔨 Link roundup! For your convenience, the big upcoming auction catalogs: Christie’s, Phillips, Sotheby’s (Important Watches and Breguet 250th Anniversary Sale), and Antiquorum. But that’s not all: Sometimes, especially with tariffs still very much a thing, it’s better to hunt for deals stateside at Freeman’s Hindman (Nov. 12) and Heritage (Nov. 20, or grab a coin watch on Nov. 10). And don’t forget about Germany’s Dr. Crott (Nov. 8).

Patek Philippe made a watch for General Motors. Speaking of that Freeman’s Hindman sale: I’ve long been fascinated by the Patek Philippe 1578GM. Only about 30 were made for General Motors executives in the 1950s, and I believe it’s the only time Patek made a reference specifically for a client. I’ll be watching this tropical 1578GM that last sold in 2017.

What happens when a watch dealer goes into administration

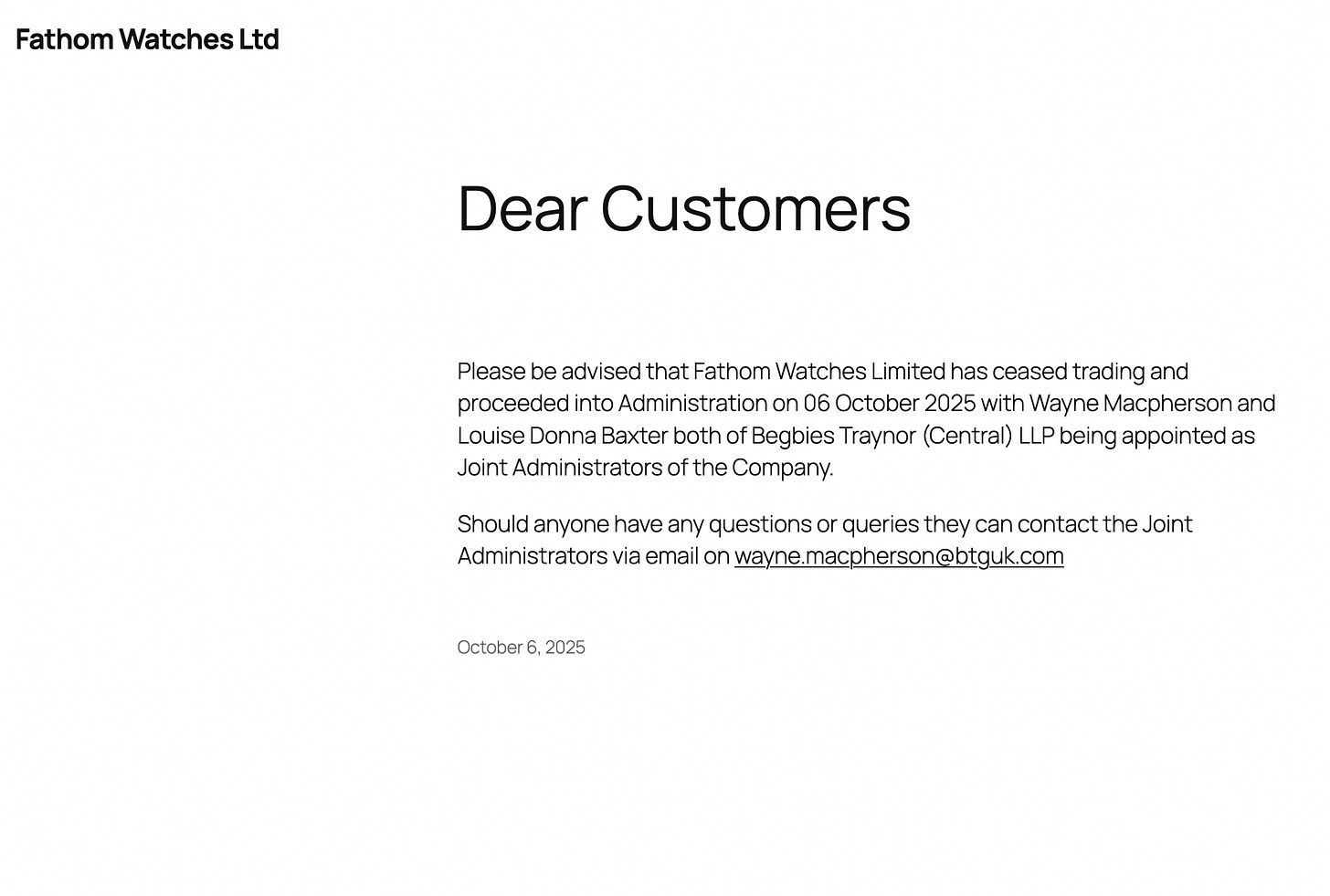

Here’s a message you never want to see from your watch dealer:

A few weeks ago, I started getting texts about Fathom Watches, a vintage dealer in London that had suddenly gone into administration. It’s a legal process in the U.K. similar to bankruptcy in the U.S. for insolvent companies that places them under the control of an independent administrator to either save the business or divvy up whatever’s left to its creditors.

Fathom has established a strong reputation over the last few years. It operates a showroom in London, has a strong client base, and produces solid content.

The story seemed odd, so I tracked down Stefano Scott-Sauro, the main man at Fathom, to hear his side. It’s a look at what happens when business partnerships go sideways, how to come back, and all with some lessons for collectors.

Stef says things went downhill on October 3.

It was a Friday, and his business partner, Ben, showed up at Fathom’s London showroom with two “agents,” saying he was bringing the company into administration.

Keep reading with a 7-day free trial

Subscribe to Unpolished Watches to keep reading this post and get 7 days of free access to the full post archives.